Since the opening policy under Deng Xiaoping in 1978, China's economic growth over the past decades has been unstoppable to the point where the United States of America's hegemony was threatened. The country's GDP has grown from $300 billion in 1978 to over $14 trillion in 2019, making China the second largest economy in the world. Benefiting from its large and low-cost labor force, the Chinese government endorsed foreign investments into the country, which helped to spur economic growth and create jobs aggressively. As a result, China has become a major hub for producing goods such as electronics, clothing, and so much more. These goods are then exported to countries all over the world, allowing China to generate a significant trade surplus which will be re-invested into the economy, and create a positive feedback loop.

Another sector that helped increase China's GDP was the real estate sector, as it accounts for more than 25% of the total GDP of China. However, as the nature of the real estate sector continues to require debt, it has placed China's economy in jeopardy.

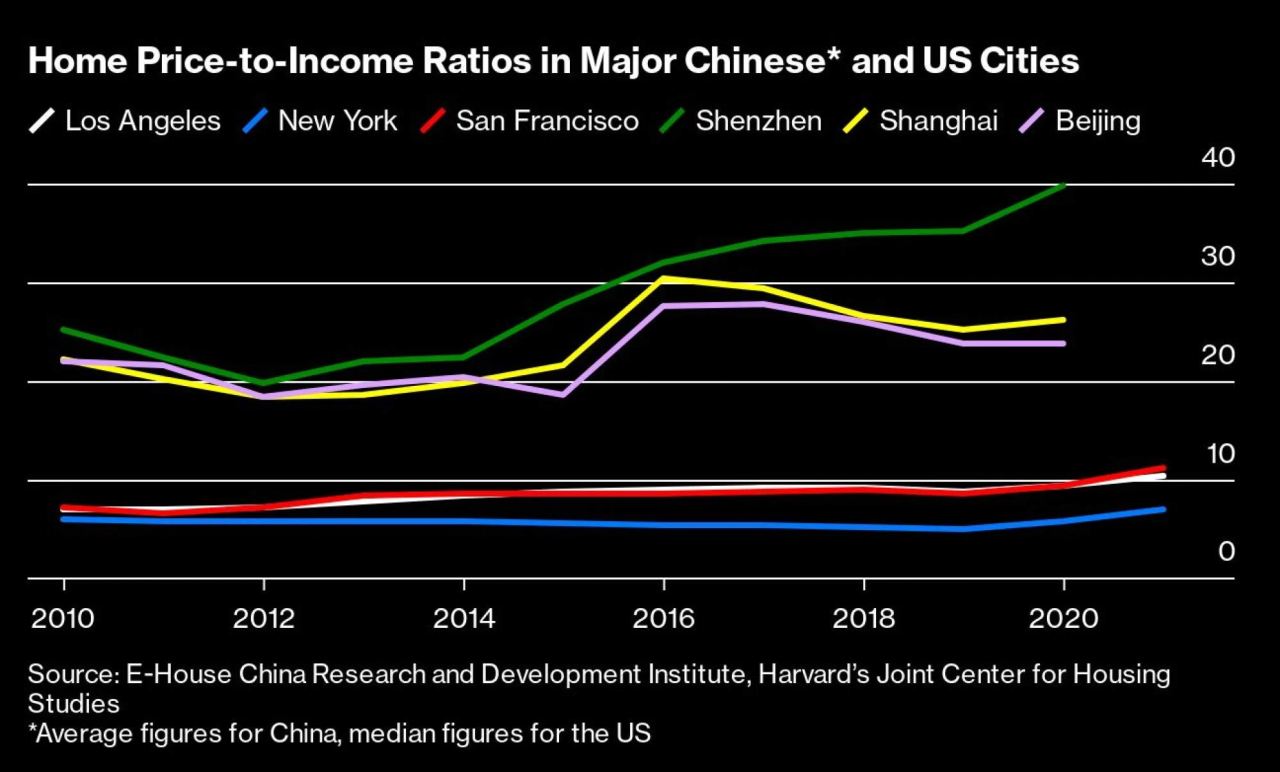

Overinvestment in the real estate sector funded by both foreign investors and the government, combined with easy access to credit, created a housing bubble in China. This bubble has not fully burst, but it is starting to trigger a wave of defaults and foreclosures of both firms and individuals. To control such a domino effect, the Chinese LGFV(local government financial vehicle) which plays an important role in Chinese fiscal policies, has deferred the re-payment of $2.3 billion for 20 years as a part of the debt restructuring plan. It is estimated that LGFV's debt is about $9.3 trillion, and the Chinese national debt is estimated to be $51.9 trillion, almost three times the size of China's GDP. Meanwhile, the Chinese government is planning to issue another debt of $1 trillion, most of which will fund the debt restructuring plan; while more than 40% of the Chinese government's debt will mature within 5 years by 2023. The real estate bubble intertwined with the great national debt will trigger a global economic crisis. When it finally burst, the local governments and state-owned firms may be forced to sell their cash-generating assets, such as highways, to manage their debt. However, the Chinese central government will intervene in the market and continue the debt vicious cycle and economic instability. As a result, China will go through a long period of economic recession and deflation like Japan after its assets price bubble in the 1990s.

I believe that the series of national security threats in the United State of America and the constant provocation of war against Taiwan is part of political propaganda to hide internal challenges and unite the Chinese public. As the economic situation in China gets worse and worse, word of threats will become military actions, and disputes will become war.